Farview Heights

TAX INCENTIVE FINANCING

(TIF)

What is a TIF?

TIF Districts

When a TIF district is created, tax revenues generated based upon the equalized assessed value (i.e., the “base value”) of properties within the TIF district are distributed to each of the taxing districts in accordance with law. Over the 23-year life of the TIF district, tax revenues generated by increases in the equalized assessed value of those properties (i.e., the “incremental value”), are deposited into a TIF fund, which is administered by the City. Monies in the TIF fund can be used to offset eligible redevelopment projects costs, including, but not limited to, the costs of:

- Studies, surveys, plans, and specifications;

- Marketing sites to prospective business, developers, and investors;

- Property assembly costs, including but not limited to acquisition of land and other property, demolition of buildings, site preparation, as well as clearing and grading of land;

- Rehabilitation, reconstruction, repair, or remodeling of existing public or private buildings, fixtures, and leasehold improvements; and

- Financing.

Fairview Heights TIF Exclusions

Excluded from eligibility are costs of construction of new privately-owned buildings. One hundred percent of the developer’s labor will be provided by contractors using labor provided by participating member trade unions affiliated with the Southwestern Illinois Building and Trades Council.

Applying for a TIF

The TIF application process is detailed in the documents attached. Prior to the City executing the Development Agreement, the applicant must pay a “Business Assistance Application Fee’ (the fee) equal to 2% of the Total Project Cost, not to exceed $500.00. The fee covers the cost of legal review, analysis, and processing of the application. The Fee is non-refundable, but should the project be delayed or terminated by actions of the City of Fairview Heights, such fee will be reimbursed.

If you wish to apply for a TIF, please download the application below and send it to the City of Fairview Heights’ Director of Land Use:

Dallas Alley

Director of Land Use

City of Fairview Heights

10025 Bunkum Road

Fairview Heights, IL 62208

Enterprise Zone

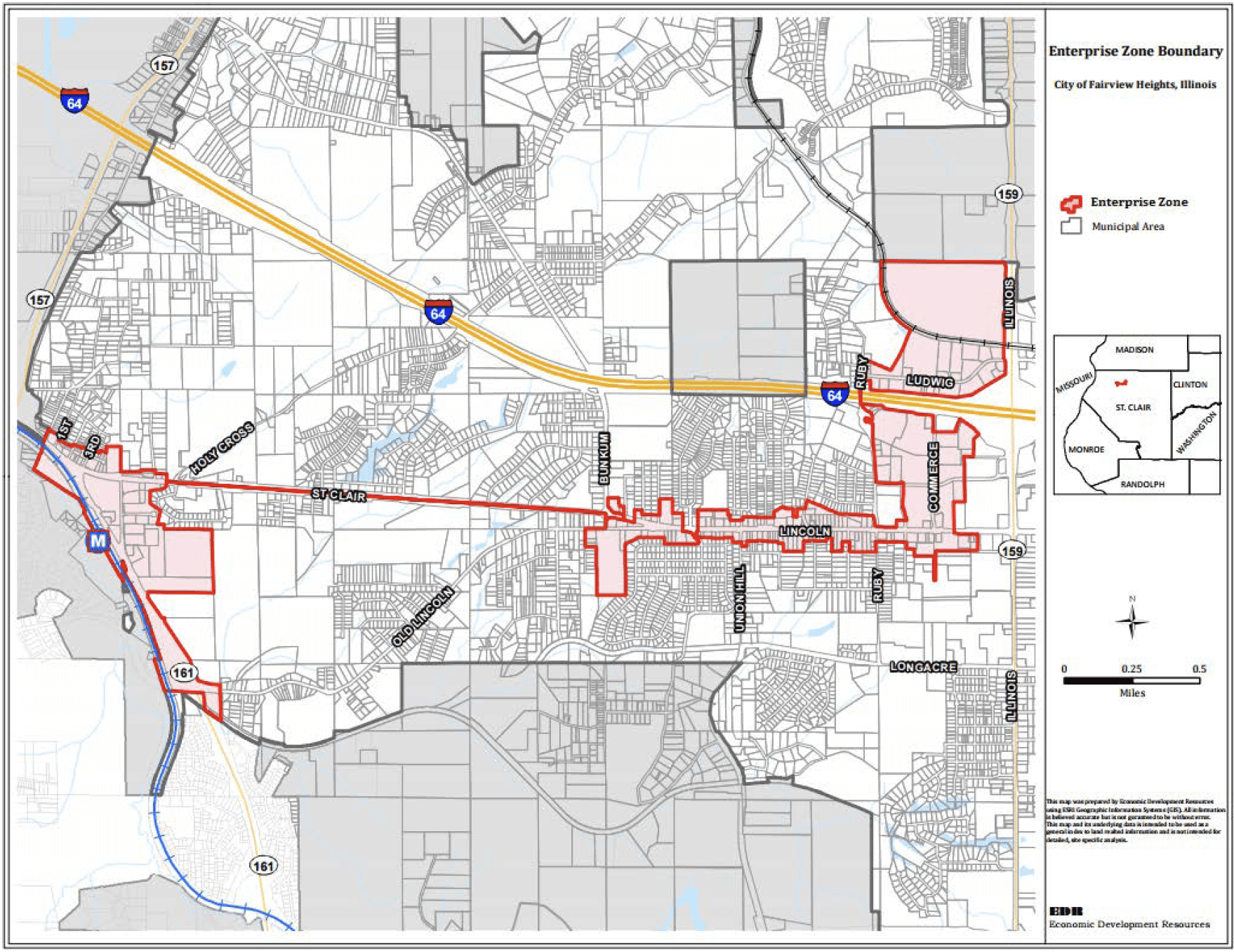

Enterprise Zone Boundaries

The size of the Enterprise Zone is 0.8 sq. miles. The boundary of the Enterprise Zone includes all property in the existing Lincoln Trail Tax Increment Financing (TIF) area and all property in the Fairview Heights TIF #4, Ludwig Drive TIF, and the State Route 159 TIF. A 5-foot strip along St. Clair Avenue is used to connect these areas in the Enterprise Zone. In addition, the City has also placed commercial properties on the south side of Ludwig Drive at Fairview Heights Plaza within the boundary of the Enterprise Zone. The size of the Enterprise Zone is within size limitations established by the Illinois Enterprise Zone Act (20 ILCS 655/1 et seq.).

The Local Labor Market Area (LLMA) for the Fairview Heights Enterprise Zone is St. Clair County. The LLMA is contiguous, compact, comprised of entire census tracts, located entirely within the State of Illinois, and is an area within which residents of the LLMA can easily change jobs and do not have to relocate outside of its boundaries.

Enterprise Zone Development Plan

- Make Lincoln Trail TIF corridor a viable commercial retail portion of the City via:

- Ongoing redevelopment efforts along Lincoln Trail TIF corridor (public/private effort)

- Provide additional Enterprise Zone incentive to existing Lincoln Trail TIF;

- Create uniformity and new “development standard” for this commercial corridor;

- Use Enterprise Zone incentive to convert uses along Lincoln Trail to commercial; and

- Incorporate mixed-use combined retail and residential centers along Lincoln Trail.

- Fill vacancies and redevelop Fairview Heights Plaza at IL 159 and Ludwig (public/private):

- Work with property owner on façade, landscaping and parking lot improvements;

- Bring building interiors up to code compliance; subdivide building space for new users; and

- Remediate physical environmental obstacles required to (re)develop 72 acres of vacant property across railroad tracks.

- Create mixed-use destination district surrounding Fairview Heights MetroLink station:

- Utilize four-phase 20-year plan developed by OneSTL to redevelop existing uses into new mixed-use district and develop new Arrowhead industrial park;

- Utilize Enterprise Zone and TIF incentives to offset high property tax rates;

- Incorporate senior living component into mixed-use district surrounding MetroLink; and

- Work with MetroLink to improve/lease Metro property before making improvements.

Incentives and Exemptions

Local Incentives and Exemptions

- Exemption on retailers’ occupation tax paid on building materials;

- An investment tax credit of 0.5% of qualified property;

- Expanded state sales tax exemptions on purchases of personal property used or consumed in the manufacturing process or in the operation of a pollution control facility;

- An exemption on the state utility tax for electricity and natural gas; and

- An exemption on the Illinois Commerce Commission’s administrative charge and telecommunication excise tax.

Exemptions are available for companies that make minimum investments that either create or retain a certain number of jobs. These exemptions require a business to make application to, and be certified by, the Illinois Department of Commerce.

Local Incentives and Exemptions

In addition to state incentives, each zone offers local incentives to enhance business development projects. Each zone has a designated local zone administrator responsible for compliance and is available to answer questions. To receive a Certificate of Eligibility for Sales Tax Exemption, you must contact the local zone administrator of the zone into which purchased building materials will be incorporated.

Apply to Join the Enterprise Zone

The Enterprise Zone application process is detailed in the documents attached. If you wish to apply to join the Enterprise Zone, please download the application below and send it to the City of Fairview Heights’ Director of Land Use:

Dallas Alley

Director of Land Use

City of Fairview Heights

10025 Bunkum Road

Fairview Heights, IL 62208

PACE (Property Assessed Clean Energy) Financing

Property Assessed Clean Energy (PACE) financing is an innovative new tool that enables commercial property owners to obtain up to 100% long-term, fixed-rate financing for redevelopment or development to improve a facility’s energy efficiency, resiliency, water use, deployment of renewable energy, and even electric vehicle charging systems. Private capital providers can provide funding for eligible improvements such as HVAC, lighting, solar photovoltaic (PV) systems and other improvements in both existing buildings and new construction projects. The term of a PACE financing may extend through the useful life of the improvement(s)—as much as 20-30 years—and can be considered as assets rather than liabilities on a project’s balance sheet.

PACE financing was approved for use in Illinois in 2018 and is gaining acceptance statewide as more property owners and developers discover its benefits. The only program currently in operation in Southern Illinois is the program in Fairview Heights.

PACE Financing Program

The purpose of the PACE Financing Program is for commercial property owners to improve their properties by installing and/or upgrading their properties with certain Energy Conservation Measures, Renewable Energy Improvements, Water Use Improvements, and Resiliency Improvements. The Property Owners can receive funding for the Energy Conservation Measures from private financing companies through bonds issued on behalf of the Program. These bonds would be secured and repaid through special voluntary property tax assessments placed on the Property through the authority of the Program.

Eligibility Requirements for Financing or Refinancing Energy Projects

Eligible Properties

Any privately-owned commercial, industrial, non-residential agricultural, or multi-family (of 5 or more units) real property or any real property owned by a not-for-profit located within the boundaries of the City.

Eligible Energy Projects

The acquisition, construction, installation, or modification of an alternative energy improvement, energy efficiency improvement, renewable energy improvement, resiliency improvement, or water use improvement affixed to real property (including new construction).

- Alternative Energy Improvement

- Energy Efficiency Improvement

- Renewable Energy Improvement

- Resiliency Improvement

- Water Use Improvement

(See Program Manual below for details)

Apply to Join the PACE Financing Program

There is a $150 non-refundable fee to be submitted with a Final Application. This fee will be applied towards the Program Fees assessed on the approved Final Application at closing.

The PACE application process along with program details are detailed in the Program Manual attached. If you wish to apply to join the PACE Programs, please visit the application website linked below.

If you need help during the application process, or to receive more information, contact:

Sustainable Solutions Funding, LLC

Website: ssfunding.net

Email: info@ssfunding.net

Phone: 314-814-7883

Economic Development Incentive Agreements

EDIA Boundaries

The Economic Incentive Agreement programs, or Sales Tax Rebates, are another tool which the City of Fairview Heights uses to stimulate economic activity, as well as to create and maintain jobs relating to development or redevelopment of land within its corporate limits. Examples of developments in which Sales Tax Rebates were made available to developers and/or companies include Lincoln Place II, Old Time Pottery, the Shoppes at St. Clair, and Fairview City Centre.

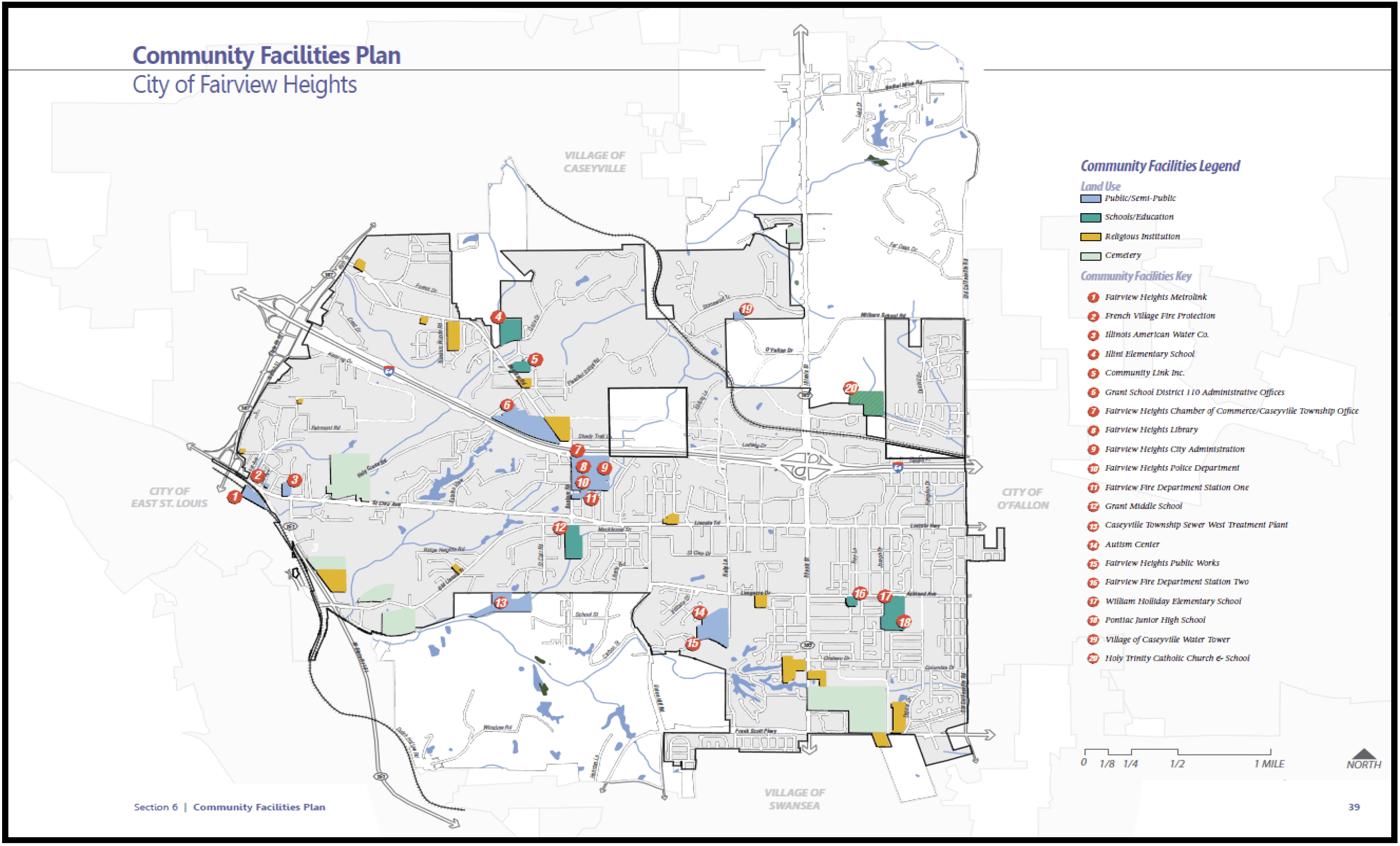

Residents and businesses in Fairview Heights received basic services from a variety of providers and community facilities. As Fariview Heights is well-established, the Community Facilities Plan (Right) largely reflects the locations of existing facilities and highlights anticipated fitire demand for services. The Plan also emphasizes coordination between the City and other local agencies and service providers with an interest in Fairview Heights to ensure the greatest level of efficiency in the provision of infrastructure and basic services.

EDIA (Sales Tax Rebate) Requirements

- If the property subject to this agreement is vacant:

- That the property has remained vacant for at least one year, or

- That any building located on the property was demolished within the last year and that the building would have qualified under findings (2) of this section;

- If the property subject to the agreement is currently developed:

- That the buildings on the property no longer comply with current building codes, or

- That the buildings on the property have remained less that significantly unoccupied or underutilized for a period of at least one year;

- That the project is expected to create or retain job opportunities within the municipality;

- That the project will serve to further the development of adjacent areas;

- That without the agreement, the project would not be possible;

- That the developer meets high standards of creditworthiness and financial strength as demonstrated by one or more of the following:

- Corporate debenture ratings of BBB or higher by Standard & Poor’s Corporation or Baa or higher by Moody’s Investors Service, Inc.;

- A letter from a financial institution with assets of $10,000,000 or more attesting to the financial strength of the developer; or

- Specific evidence of equity financing for not less than 10% of the total project costs;

- That the project will strengthen the commercial sector of the municipality;

- That the project will enhance the tax base of the municipality; and

- That the agreement is made in the best interest of the municipality.

Apply for EDIA (Sales Tax Rebate)

Prior to the City executing the Development Agreement, the applicant must pay a Business Assistance application fee equal to 2% of the total project cost, not to exceed $500.00. The fee covers the cost of legal review, analysis, and processing of the application. The fee is non-refundable, but should the project be delayed or terminated by actions of the City of Fairview Heights, such fee will be reimbursed.

The EDIA application process is detailed in the documents attached. If you wish to apply to join the Enterprise Zone, please download the application below and send it to the City of Fairview Heights’ Director of Development:

Dallas Alley

Director of Land Use

City of Fairview Heights

10025 Bunkum Road

Fairview Heights, IL 62208

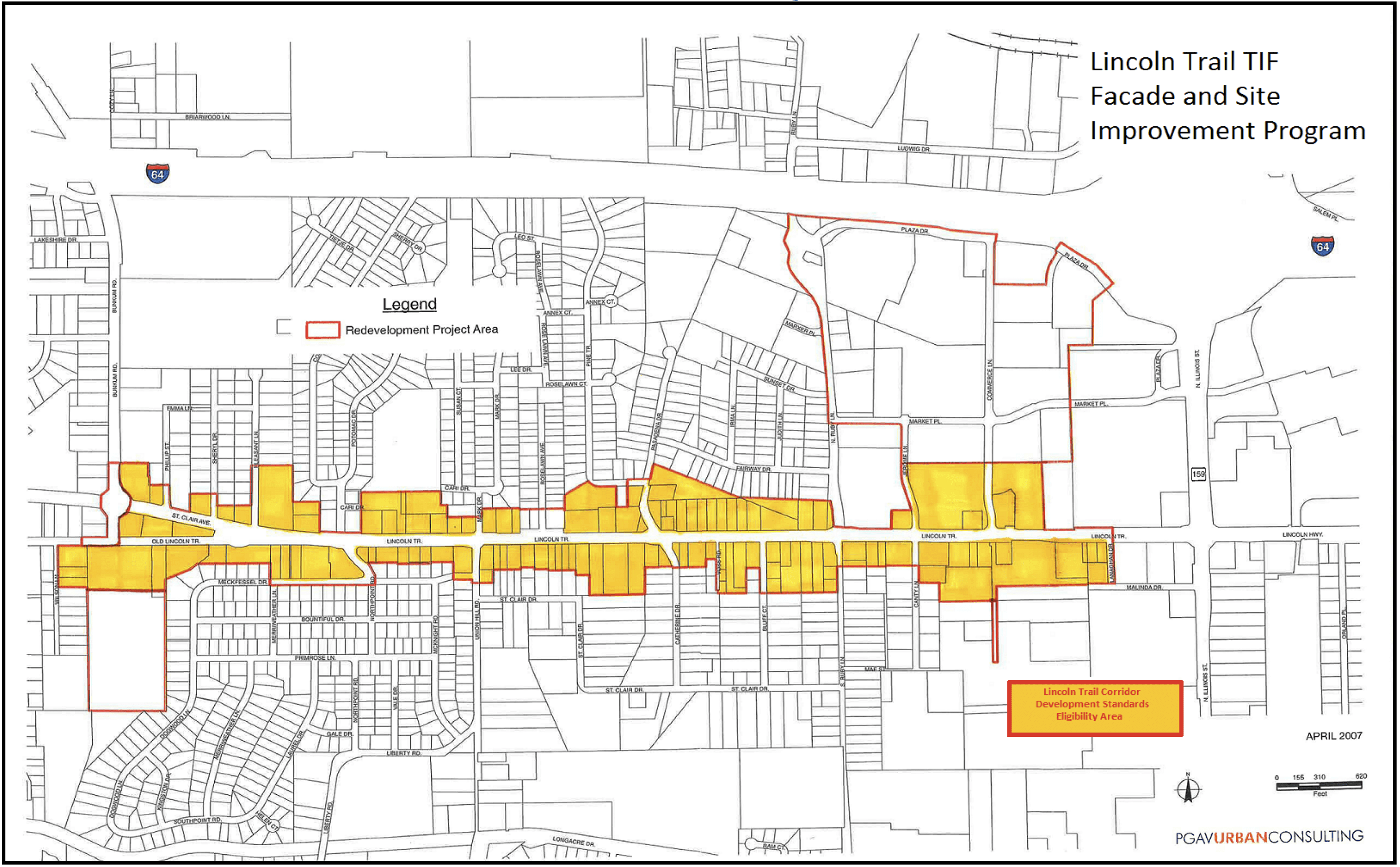

Lincoln Trail TIF Façade & Site Improvement Program

The Lincoln Trail TIF Façade & Site Improvement Program Goals

The Lincoln Trail TIF Façade & Site Improvement Program has been designed to promote the attraction and retention of business operations and enhance the interest in visiting the Lincoln Trail Corridor and Market Place Center. Property owners who utilize the program to make improvements are investing in the Lincoln Trail Redevelopment Area and over time will foster other owners to undertake improvements, and ultimately the taxable value of these improved properties will increase.

Recipient Eligibility

Property Eligibility

- Property must be located within boundaries of the Lincoln Trail TIF District

- Structure must have at least 50% of total floor space devoted to commercial use;

- Proposed improvements must be visible from public right-of-way; and

- Property must be subject to payment of property taxes.

Applicant Eligibility

- Applicant must be the property owner;

- Property must be current on payments for taxes, mortgages and City service accounts;

- Projects that have begun principle construction or façade and site alterations before final City Council grant approval will be ineligible for the façade and site improvements program;

- Owner must pay 100% of project costs prior to receiving facade and site grant; and

- Owner must obtain two qualified contractor bids. One hundred percent of Developer’s labor must be provided by contractors using labor provided by participating member trade unions affiliated with the Southwestern Illinois Building and Trades Council.

Project Eligibility

Detailed descriptions and photographic examples of the twenty six categories of eligible enhancements/improvements to building exteriors and sites begin on Page 25 of this document, including the Lincoln Trail Corridor Development Standards – Checklist, Pages 41-42.

Recipient Limitations

All work must be performed in compliance with the City of Fairview Heights’ Building and Development Codes. Owner must obtain Certificate of Completion from City Code Enforcements Office prior to disbursement of façade and site grant monies;

Work involving structural members may, at the discretion of the City Code Enforcement Office, require the certificate of a registered architect or engineer;

Changes to the project plan after City Council approves the façade and site grant application, that significantly or materially alter the scope of work or aesthetic quality of the façade and site may be disqualified. To remain eligible, such projects must submit changes to the Director of Land Use, Planning and Community Development for approval;

Buildings receiving façade and site grants will be ineligible to receive additional façade and site grants for 36 months (3 years) after disbursement of funds;

Applicants will be required to submit a rendering of the project showing proposed façade improvements as well as site plan improvements with the application. The rendering need not be done by an architect or paid artist, but must accurately represent the intent, scope of work, and aesthetics the project is planned to achieve; and

Property must remain primarily commercial (50% or more of floor space) and be reasonably maintained for a minimum of three (3) years following completion of the façade and site work, and real estate taxes paid timely, or a portion of the grant will be returned to the City.

Apply for the Site Improvements Program

Prior to the City executing the Development Agreement, the applicant must pay a Business Assistance application fee equal to 2% of the total project cost, not to exceed $500.00. The fee covers the cost of legal review, analysis, and processing of the application. The fee is non-refundable, but should the project be delayed or terminated by actions of the City of Fairview Heights, such fee will be reimbursed.

The Lincoln Trail TIF Façade & Site Improvement Program standards are detailed in the documents attached. If you wish to apply to for the Lincoln Trail TIF Façade & Site Improvement Program, please download the application below and send it to the City of Fairview Heights’ Director of Land Use:

Dallas Alley

Director of Land Use

City of Fairview Heights

10025 Bunkum Road

Fairview Heights, IL 62208